Tokenomics of $CLONE

Token info

Total supply: 1,000,000,000

Ticker: $CLONE

Initial Chain: Bridgeless L1

Total Clone Supply is fixed at 1 billion tokens.

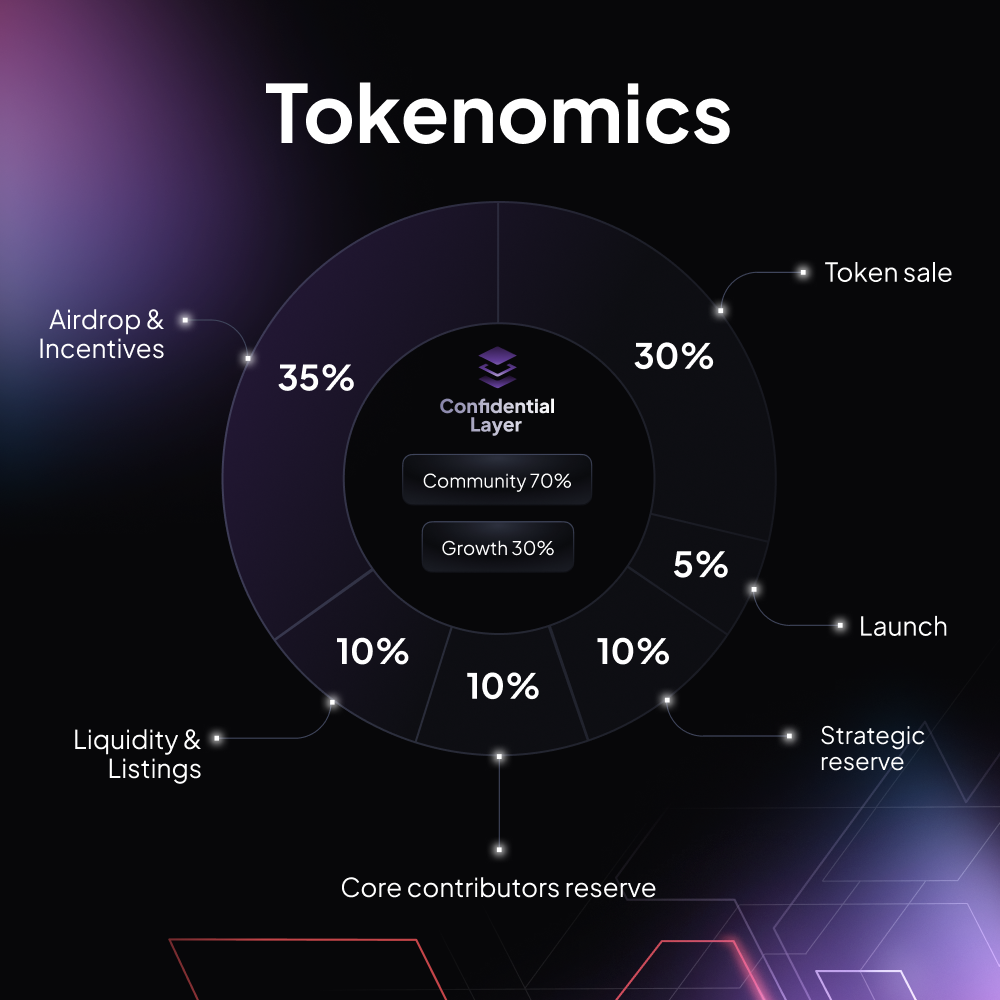

Confidential Layer's tokenomics is structured with a clear focus on community ownership and incentivizing user adoption. A majority of the total supply (70%) is reserved for the community, aligning with the protocol’s goal of expanding user engagement and creating a decentralized ownership structure. This allocation is a strategic move designed to capture mindshare, incentivize participation, and reward users as Confidential Layer gains traction.

Token allocation

Pre-sale (30%)

30% is allocated towards sales to communities and contributors, giving them a chance to participate in the network’s growth from the ground up. The breakdown includes:

Communities & Contributors (8%): is reserved for early communities in the development and early support of Confidential Layer, ensuring that contributor communities are able to participate with the good terms for their efforts and early support and adoption.

Private-sale (2%): is reserved for helpful participants of the community.

Discord sale (13.5%): is allocated for Discord members via the "Airdrop sale" and "Last Chance sale", ensuring that Confidential Layer community members have an opportunity to participate in $CLONE before the official public listing.

Partners (6.5%): is reserved for core partners to align the vision, goals, and interests of all parties.

Airdrops & Incentives (35%)

To drive user adoption and expand the Confidential Layer network, 35% of the total token supply is reserved for airdrops and incentives. This substantial allocation ensures a steady stream of user engagement while rewarding both early and future participants. Here's how the allocation breaks down:

Incentives (15%): This portion will go towards various incentivized programs designed to reward our partners and participants for helping with the growth.

Airdrops (20%): Airdrops are strategically planned to stimulate growth and engagement at key phases in the protocol’s lifecycle. Airdrops will be divided into three categories: Pre-Launch/Launch, Communities Airdrop for Future Growth and Volume Multiyear Airdrop

Liquidity & Listings (10%)

10% Liquidity & Listings allocation will support strategic listings that will bolster market presence and trading activity, ensuring that users can seamlessly buy, sell, and trade CLONE tokens in the future.

Launch (5%)

The initial launch of the CLONE token will see 5% of the supply allocated to launch activities.

Core Contributors & Strategic Reserve (20%)

Confidential Layer’s long-term vision relies heavily on its core team and current & future strategic partners. To align incentives and ensure continued dedication, 10% of the total supply is allocated to core contributors and another 10% is reserved for strategic initiatives. These tokens will be subject to the longest lock periods, with a 6-month cliff, after which they will have a stakelock and a subsequent 24-month linear unlock. This extended lock ensures that the most crucial stakeholders remain fully invested in the future success of the Confidential Layer protocol.

Last updated